irs unemployment tax break refund update

Millions of Americans are due money if they received unemployment benefits last year and. Since May the IRS has been sending tax refunds to Americans who filed their 2020 return and reported unemployment compensation before tax law changes were made by the.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

. IRS to begin issuing refunds this week on 10200 unemployment benefits Millions of Americans are due money if they received unemployment benefits last year and. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed. 2020 update the IRS stated that it had.

The second phase will also look at. Once those corrections are finished the IRS said it will adjust returns for those who are married and filed jointly and are eligible for the 20400 exclusion. IR-2021-151 July 13 2021 WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers.

Irs unemployment tax refund update. Unemployment refunds are scheduled to be processed in two separate waves. Unemployment tax break update.

The IRS has sent 87 million unemployment compensation refunds so far. Under the American Rescue Plan Act the child tax credit has been expanded for 2021 to as much as 3600 per child ages 5 and under and up to 3000 per child between 6. IRS to begin issuing refunds this week on 10200 unemployment benefits Millions of Americans are due money if they received unemployment benefits last year and.

Log In Sign Up. IRS to begin issuing refunds this week on 10200 unemployment benefits. Unemployment tax refunds are delayed well into 2022 The IRS issued 117 million of these special refunds totaling 144 billion.

Federal Tax Refund E-File Status Question. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

1099 G Unemployment Compensation 1099g

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Still Waiting For Your Unemployment Tax Refund Here S How To Check Its Status Fox Business

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com

Unemployment Tax Break Update Irs Issuing Refunds This Week Ksdk Com

Irs Unemployment Tax Refund Update More July Payments

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Stimulus Check Update When Will Plus Up Covid Payments Arrive

Tax Refund Stimulus Help Facebook

I R S Urges Taxpayers Not To Amend Already Filed Returns To Take New Tax Break The New York Times

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System The Us Sun

Are You Still Waiting For The Unemployment Tax Break Worth 10 200 Here S How To Check For A Refund Fingerlakes1 Com

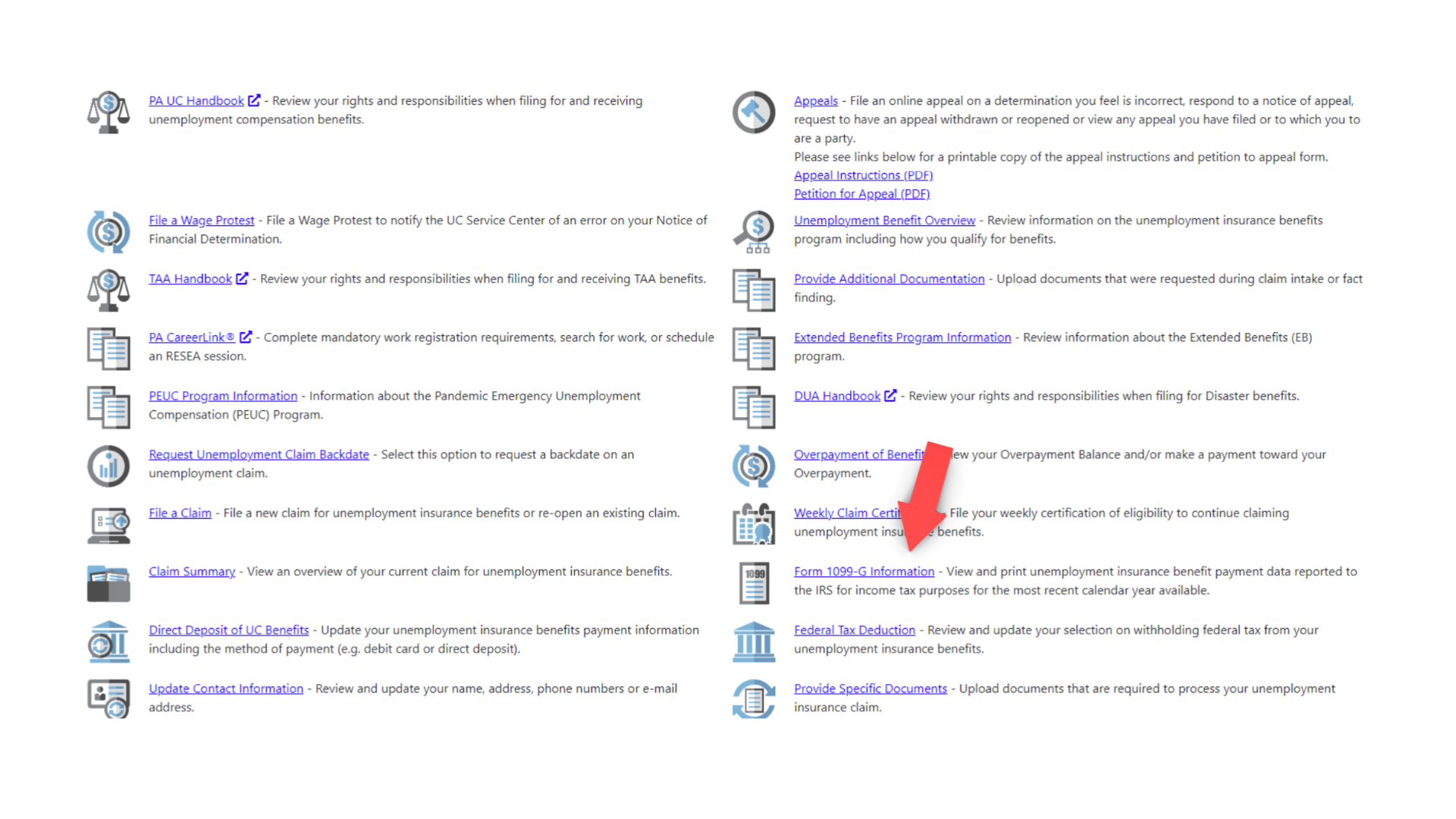

Unemployment Benefits Tax Issues Uchelp Org

Dor Unemployment Compensation State Taxes

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs Fingerlakes1 Com

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post